Fly In Fly Out Workers

Stage Three tax cuts

Tax cuts 2024 Tax Cuts are meant to be here from 1/7/2023 Just to refresh, here’s a simplified version of what the brackets are now: Earn up to $18,200 – pay no tax Earn $18,201 to $45,000 – pay a 19 per cent tax rate Earn $45,001 to $120,000 – pay a 32.5 per cent…

Read MoreTimes are tough finances ideas

Times are tough finances ideas – Ways to save explained. Ever wondered what more you can do to combat the ever increasing cost of living? With the ever increasing cost of living, Romeo Caporaso explains vital areas of your finances to review.

Read MoreHELP debt and tax explained

HELP debt and tax explained How HELP debt is repaid at the tax return is often misunderstood. We explain how it works in this short video.

Read MoreATO Scam tips

Why it is important to protect your tax file number. Some of you may already be aware how important it is to protect your tax file number (TFN) from getting into the wrong hands. Crooks can use your TFN for TFN fraud, such as present themselves as you to the ATO , do your tax…

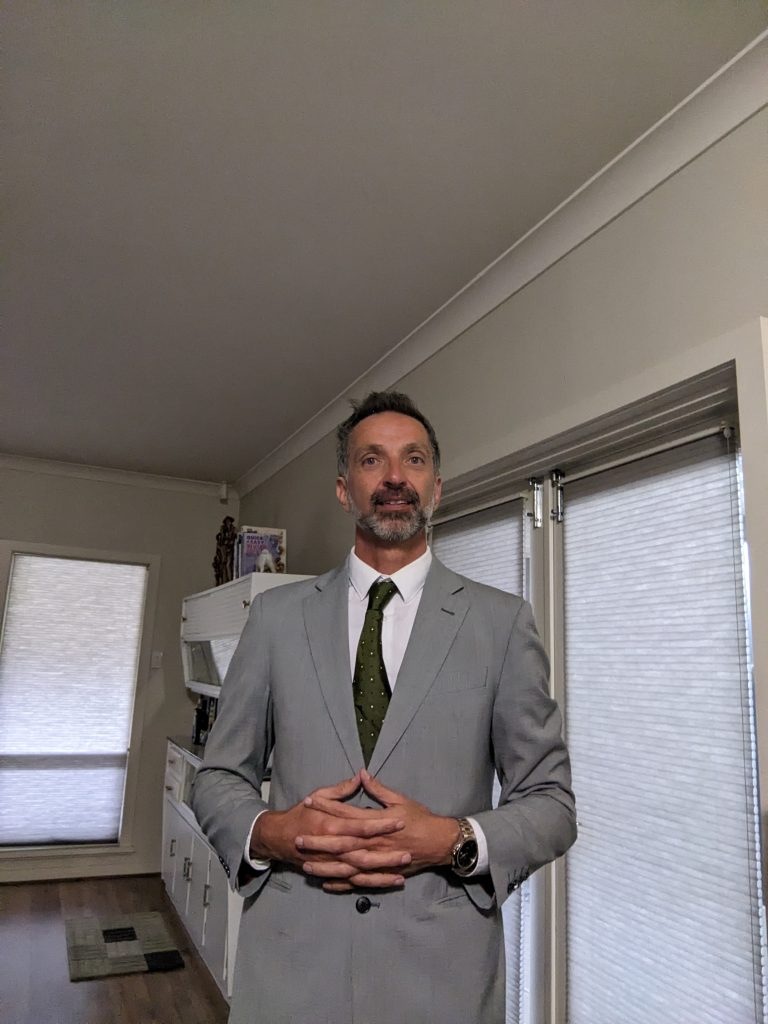

Read MoreHow Tax Accounting Adelaide can assist YOU!

Our services include: Tax Returns Individual, Business, Self-Managed Super Fund Advice Capital Gains, Property, Starting a new business or buying a business, Working overseas, SA land tax, and many more! Accounting New Software Implementation, Performance Reporting and Meetings, Bookkeeping, BAS returns. Business Improvement Services Coaching, Small business marketing, Business check…

Read MoreYour Guide To Choosing The Right Accountant

Choosing the right accountant for your personal and professional needs may seem daunting but it’s a necessary step for you to maximise your current financial position and proactively plan for your future. The right accountant can do a lot more for you besides preparing your annual tax return. This important relationship should benefit you financially,…

Read MoreHow A Registered Tax Agent Can Help You This Financial Year

You may believe your tax agent’s sole purpose is helping you with your tax return at the end of the financial year, however, this is only part of the services they usually offer. In most cases and depending on your circumstances, they are able to offer valued support in other ways. Here are some of…

Read MoreNew COVID19 working from home office claim

New working from home shortcut The ATO has announced a new arrangement to make it easier to claim deductions for working from home. Taxpayers can now claim 80 cents per hour working from home. This can apply to more than one person in a household. So 80 cents per hour of each person in the…

Read MoreClient Referral Incentives

We are looking for referrals from our clients and are looking for genuine referral partners We really need your help? Can I show you how to refer to us and the incentives we offer? Yes we pay you, for referrals. Our short video explaining the client incentives we offer you to refer us clients like…

Read MoreThinking of working overseas

If you are an Australian considering working overseas, we recommend seeking tax advice to plan fully for your Australian Tax Law implications. Importantly … Australian residents are generally taxed on their income from all sources, in and out of Australia. However if you are a non resident of Australia you are only taxed on income…

Read MoreHere’s What To Do With A Late Tax Return

Are you late in lodging your tax return? Here’s some information you should know and the steps to take if you are in this situation. The Australian Taxation Office (ATO) may or may not initially detect you. Whether they do or don’t, we suggest you take urgent action to get your taxes back up to date…

Read MoreWhat to look for in a tax agent?

An accountant can do your tax return each year provided they are a registered tax agent. When registered this implies that they have qualifications, are a member of a professional society with ethical and professional standards and have the relevant insurances to perform this role. You can check their registration at the online tax and…

Read MoreHow can a professional tax accountant help me?

There are many great assists that a good tax accountant can give you, here are some of these: Your accountant should be familiar with your worker industry, they can not only help you with this year’s tax deductions but educate you on what your occupational colleagues are claiming or what you can do even better…

Read MoreIs it worth having a tax agent?

Is it worth paying a Tax Agent or Accountant It is no secret many people do their own tax returns directly with the ATO by the paper form which is dying out as the ATO would like everything lodged electronically to lower costs. Now you need to download software from the ATO and lodge on…

Read MoreAustralian Tax Treatment of Working Overseas

Australian Tax Treatment of Working Overseas Working overseas can seem to be a hugely rewarding financial period for many Australian workers, however, there can be many tax traps that need to be avoided. The way income is earned and taxed overseas can be a complex area, and it is worth seeking advice that can save…

Read More