property investors and landlords

Stage Three tax cuts

Tax cuts 2024 Tax Cuts are meant to be here from 1/7/2023 Just to refresh, here’s a simplified version of what the brackets are now: Earn up to $18,200 – pay no tax Earn $18,201 to $45,000 – pay a 19 per cent tax rate Earn $45,001 to $120,000 – pay a 32.5 per cent…

Read MoreWe are now Gold partners of Xero Software

Gold partners of Xero Software We recently became Gold partners of Xero. This means we have many Xero business clients and are Xero proficient. Feel free to meet us if you want an accounting partner to support your business and use Xero. Find out more about Xero in our demonstration Introduction to Xero | Tax…

Read MoreTimes are tough finances ideas

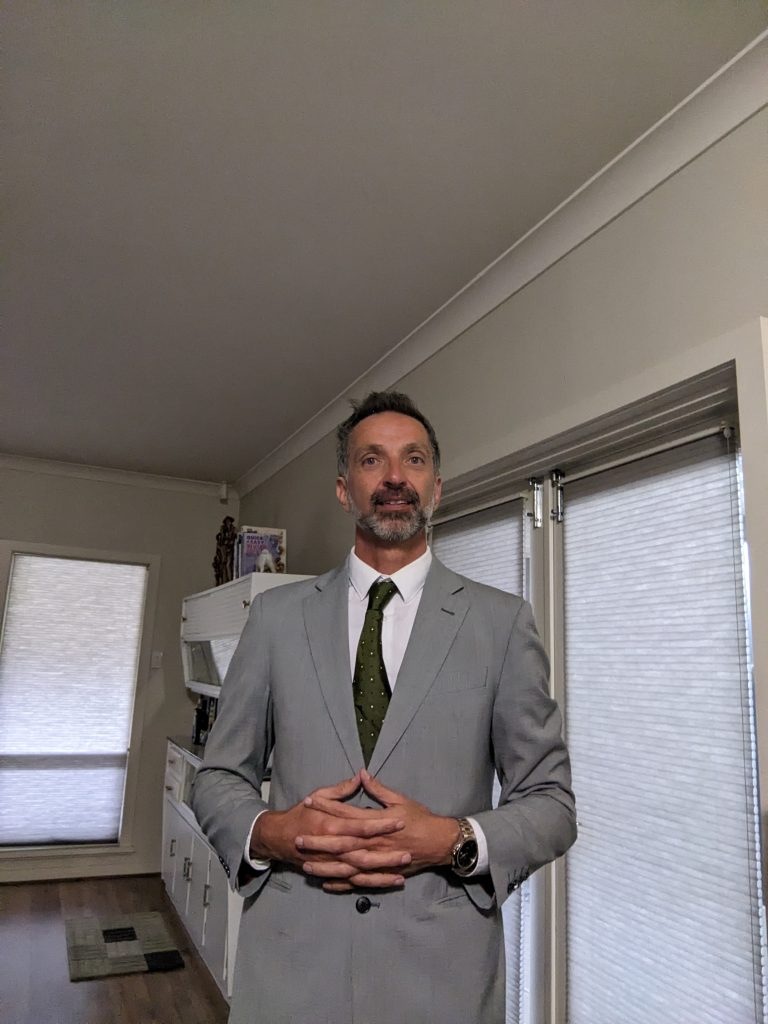

Times are tough finances ideas – Ways to save explained. Ever wondered what more you can do to combat the ever increasing cost of living? With the ever increasing cost of living, Romeo Caporaso explains vital areas of your finances to review.

Read MorePay as you go Tax Instalments explained

Pay as you go Tax Instalments explained Listen to our quick lesson on pay as you go tax instalments including how they work and how the ATO automates them in certain circumstances.

Read Moretaxable income and adjusted taxable income difference

Taxable income and adjusted taxable income differences, explained. There is a common confusion over the difference between adjusted taxable income (used for non tax calculations such as government payments, family benefits , child support and private hospital government contributions) and taxable income which is used for tax on income. Taxable income is income less deductions…

Read Morehow to better claim common tax deductions

how to better claim common tax deductions This tax season is going great so far. The ATO are seemingly quiet and are processing some tax returns as quickly as 5 days. Some areas to prepare your deductions before your tax return appointment are: Doing a diary of working from home hours and…

Read MoreShare investing ideas

Share investing Are you thinking of starting a share portfolio? Or if you aren’t yet, then perhaps you should be. I must say being an accountant, I began to take notice when seeing my clients show me their substantial share portfolios, often commencing them as late as their fifties. Reasons why you would invest in…

Read MoreATO Scam tips

Why it is important to protect your tax file number. Some of you may already be aware how important it is to protect your tax file number (TFN) from getting into the wrong hands. Crooks can use your TFN for TFN fraud, such as present themselves as you to the ATO , do your tax…

Read MoreHow company saves tax explained simply

How to save tax in business using a company Most companies are now taxed at 25% from each $ of profit from 1/7/21 Whereas individual takes rates are higher than this from each dollar over $45000 So businesses can take advantage of the lower individual tax rates by paying themselves individual income from…

Read Morewhat is new for tax 2021

Changes to tax returns 2021 ATO Warning – Copy & Pasting Claims ATO are setting their sights on work related expenses (such as motor vehicle, travel claims, laundry, uniform purchases and business trips). The expectation is that these deductions should reduce for taxpayers who were working from home during COVID 19. However, the ATO…

Read MoreWhy to own investment property in Self manged Super Funds

Something you need to know if you are growing an investment property portfolio. Find out what here… Let say Luigi and Maria Retire with 8 rental properties owned outright Sounds great But if they owns them individually They could still have a high taxable income Lets assume 40k taxable income each So that…

Read MorePlanting the trees of investment to accumulate wealth

The key to creating wealth is Investing Are you interested in accumulating wealth? Whatever your circumstances or age, the key is invest, invest and invest and soon your investments will be strong and continue growing like trees. Here are some quick tips: Whether you are in business or employed are irrespective of your income…

Read MoreUnknown secret as why you should have a smsf

Little known reason why SMSF work Many of you may be aware in the world of Superannuation that the uptake on Self Managed Super Funds (SMSFs) continue to grow in number of funds across Australia. Self managed super funds stack high in terms of value in the total of Superannuation funds held in total in…

Read MoreWork From Home Tax Deductions explained

Work From Home Tax Deductions explained We understand that due to COVID-19 your working arrangements may have changed. If you have been working from home, you may have expenses you can claim a deduction for at tax time. Home Office deduction on tax return: requirements, records to be kept, what can be claimed. why…

Read MoreLand tax relief for landlords in South Australia

Land tax relief for landlords in South Australia Land tax relief is available for eligible non-residential and residential landlords and eligible commercial owner-occupiers in response to COVID-19. The relief is available for residential and non-residential landlords over two periods. The initial period of land tax reduction was based on rent relief the landlord has provided to tenants impacted by COVID-19 or…

Read More