Posts Tagged ‘tax agent adelaide’

Stage Three tax cuts

Tax cuts 2024 Tax Cuts are meant to be here from 1/7/2023 Just to refresh, here’s a simplified version of what the brackets are now: Earn up to $18,200 – pay no tax Earn $18,201 to $45,000 – pay a 19 per cent tax rate Earn $45,001 to $120,000 – pay a 32.5 per cent…

Read MoreTimes are tough finances ideas

Times are tough finances ideas – Ways to save explained. Ever wondered what more you can do to combat the ever increasing cost of living? With the ever increasing cost of living, Romeo Caporaso explains vital areas of your finances to review.

Read MoreEmployees Working from home deduction changes for 2022–23

Employees Working from home deduction changes for 2022–23 The record keeping requirements and methods for calculating working from home deductions has changed for the 2022–23 income year onwards. The shortcut method of calculating work from home of 80cents per hour will cease from 2022 tax returns. From the 2022–23 income year, the methods available to…

Read MoreHow company saves tax explained simply

How to save tax in business using a company Most companies are now taxed at 25% from each $ of profit from 1/7/21 Whereas individual takes rates are higher than this from each dollar over $45000 So businesses can take advantage of the lower individual tax rates by paying themselves individual income from…

Read MoreWhen to lodge your tax return by – with your tax agent

When do you have to do tax return by? Today we are explaining when you have to do your tax return by when you have a tax agent. If you have already done your tax return for this year you can listen to this for next year in case you ever need to lodge later…

Read MoreBudget 2020 summary

Our Budget 2020 announcement summary The Budget was “all about jobs” (including creating new jobs and getting the unemployed back into work again) and getting the economy moving again. Some great news – tax cuts to individual tax rates. Bring forward of the second stage of the personal tax cuts by 2 years to 1…

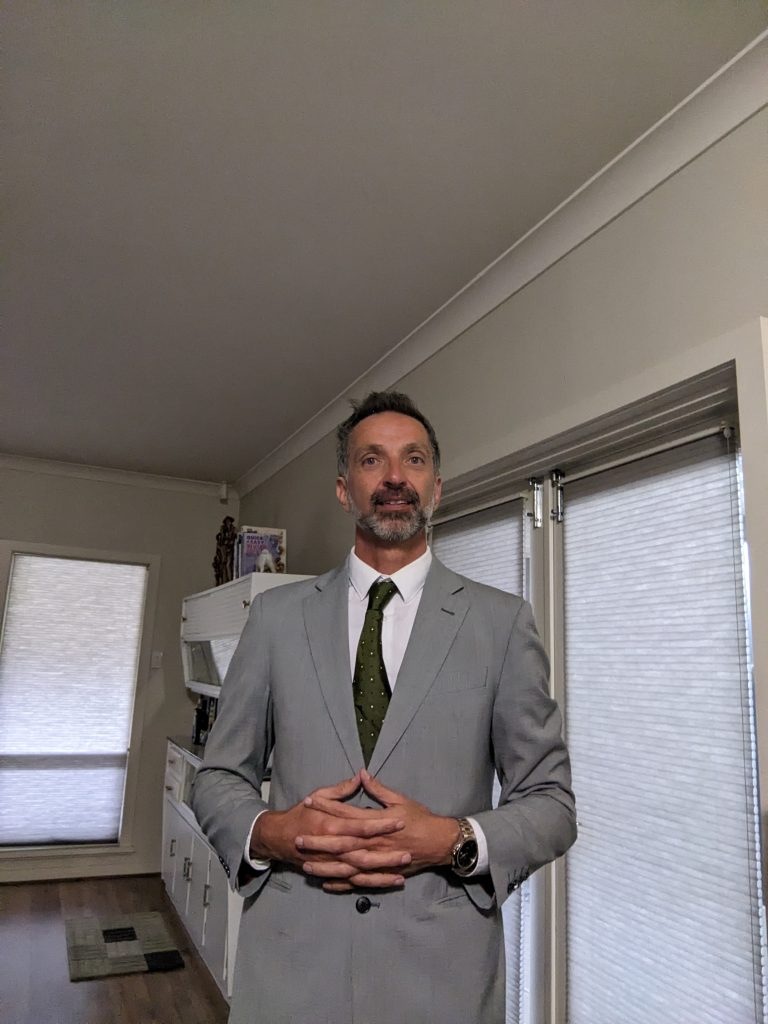

Read MoreGet Your Finances Back On Track With A Qualified Accountant!

A qualified accountant, such as one from Tax Accounting Adelaide can help you get your finances back on track. If you’ve ever struggled with keeping up to date with your income and expenses, been swamped with a messy pile of receipts and invoices that only gets sorted at tax time each year, Tax Accounting…

Read MoreJob keeper Changes

Job keeper Changes Oct 2020 If you currently receive JobKeeper Payment it remains unchanged and available until 27 September 2020. New applications for JobKeeper remain open, subject to meeting the relevant eligibility requirements. On 21 July 2020, the Government announced an extension of the JobKeeper Payment until 28 March 2021, targeting support to those businesses and not-for-profits who continue to…

Read MoreHow Tax Accounting Adelaide can assist YOU!

Our services include: Tax Returns Individual, Business, Self-Managed Super Fund Advice Capital Gains, Property, Starting a new business or buying a business, Working overseas, SA land tax, and many more! Accounting New Software Implementation, Performance Reporting and Meetings, Bookkeeping, BAS returns. Business Improvement Services Coaching, Small business marketing, Business check…

Read MoreTop business advice

What business owners say is their best advice When we asked business owners their greatest lessons learned or best business advice they said: Stick to running one business in the early days Get your price right, not too low and not too high Make the hard decisions early Surround yourself with the right…

Read MoreTake the Stress Out Of Tax Returns With Tax Accounting Adelaide!

Do you want to reduce the stress and increase the return in your Tax Return? Read on to find out how you can benefit from choosing Tax Accounting Adelaide as your tax agent. A face to face service with tax agent Tax Accounting Adelaide is most likely to prompt and uncover the most…

Read MoreHow A Registered Tax Agent Can Help You This Financial Year

You may believe your tax agent’s sole purpose is helping you with your tax return at the end of the financial year, however, this is only part of the services they usually offer. In most cases and depending on your circumstances, they are able to offer valued support in other ways. Here are some of…

Read MoreRental Property Summary – Ideal for Property Investors Tax and BAS Returns

We help investment property investors, see what problems and how we solve How we help landlords create wealth! Rental Property Summary How we help landlords and rental property owners How we help landlords create wealth! Having trouble getting together information on your investment property for your tax or bas return. Here are some templates…

Read MoreWhy you need an accountant

Why you need an accountant Why do I need an accountant? You may be asking. Perhaps you have never used one and do your own or have not seen fully what they can do to be worth more than their investment cost. Here are some reasons why a professional tax agent may be able to…

Read MoreWhat to Bring for Your Individual Tax Return

So what do you need to bring for your individual tax return appointment? 1. A copy of your last tax return 2. Your tax file number 3. Payment summaries of employment government or super payments 4. A hospital cover tax statement 5. Bank interest and dividend amounts 6. Your bank details for your refund 7. Your…

Read More