How company saves tax explained simply

How to save tax in business using a company

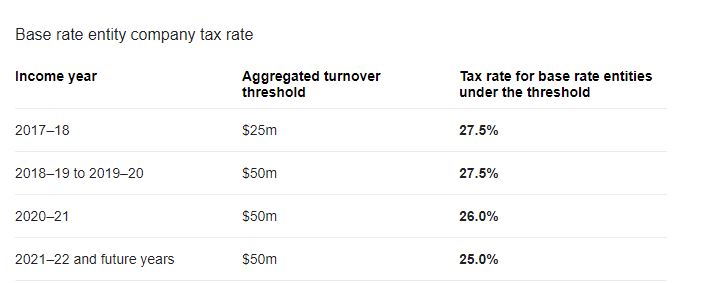

Most companies are now taxed at 25% from each $ of profit from 1/7/21

Whereas individual takes rates are higher than this from each dollar over $45000

So businesses can take advantage of the lower individual tax rates by paying themselves individual income from the company of at least $45000

From thereafter each dollar of profit in the business is best taxed in the company at a lower tax rate of 25%.

Please note you cannot simply do this but take out the money from the company. It must stay in the company. Remember you are getting a lower tax rate instead of the higher individual tax rate.

To take the money from the company you must either pay wages or receive a dividend. The taxes paid by a company on the profit can be claimed in the individual dividend called a franking credit.

If you take the money from the company you will have to repay it to the company with interest at an interest rate deemed by the ATO called ato benchmark interest rate or be deemed to have taken an unfranked dividend as income from the company.

Business a new accounting way New Entity Book Tax Minimisation New business advice