Use Companies to Minimise Your Tax

Did you know there has been recent reductions to the company tax rates. Making it an important time for businesses to make sure they are reviewing their trading entity to minimise business tax.

Why using companies to reduce your tax makes sense

When a business is increasing in profit, it may pay for a review of your operation accounting entity structuring.

If you are a sole trading or partnership business and experienced growth in profit to say about the $80,000 mark it may be time to review your tax situation with your accountant.

Do you know what the company tax rates are?

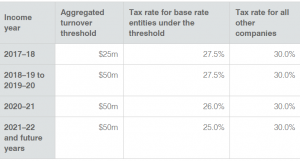

Answer – In general if you are a small business and trading as a company each dollar of profit is taxed at 26% from 1/7/2020 to 30/6/2021 and then 25% from 1/7/2021.

Do you know what individual tax rates are?

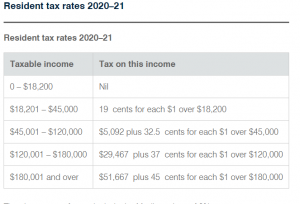

This table shows that earning above $45,000and you are taxed at a rate of 32.5% for each additional dollar earned. We have a progressive taxation system which means we are taxed even more above $120,000 37% becomes the tax rate and then above $180,000 becomes tax is at 45%. You may have noticed this is higher than the company tax rate.

You may now already see that armed with this basic knowledge of the company tax reties and individual tax rates you may need to make sure you are reducing tax effective by trading in the right entity. You can see that above $45,000 profit and you can ask if minimising tax in a company could be right for you.

Are you earning solid profits

So as I mentioned in the introduction, growth to $80,000 or perhaps even as low as $45,000 and it could be time to review if a company is right for you. The question to ask your accountant is can additional profits above $45,000 be structured to the lower company tax rate.

It isn’t always easy as ABC

There are greater complexities in operating under a company and these include:

- unlike a sole trading business, there are some formation costs of establishing and maintaining a company as there is a annual Asic return fee. Asic is a government body administering and regulating companies in Australia.

- tax returns of companies can be more complex and so your annual business tax return cost may be higher too; It will have a different TFN tax file number and this is to be used on the annual tax return of the company.

- changing trading to a company will require you to use a new ABN Australian Business Number. This is worth mentioning as some additional administration may be caused such as changing you bookkeeping to a new entity, changing stationary electronic and printed and transferring debtors and creditors or depreciation items to a new entity.

- the company owns the money that the business earns – the individuals who control the business cannot take money out of the business, except as a formal distribution of the profits or wages. This is important and your accountant should control and guide you to complying with the laws here. Importantly, you cannot have the lower company tax rate and take out the money, unless it is declared as an individual dividend or as wages and individual tax is paid on it. Your accountant can also utilise the taxes paid on individual dividends paid, this is called franking credits.

- Another consideration is that a company can help with asset protection. Trading in a company can keep the assets of company directors safer from potential business risks such as laws suits or bankruptcy.

To discuss your individual circumstance and reviewing to a company call our office at 83374460 to make an appointment to discuss it with our accountant.

More than just Bookkeeping, Bas returns and Tax returns – At Tax Accounting Adelaide we use accounting to grow your business