Why to own investment property in Self manged Super Funds

Something you need to know if you are growing an investment property portfolio.

Find out what here…

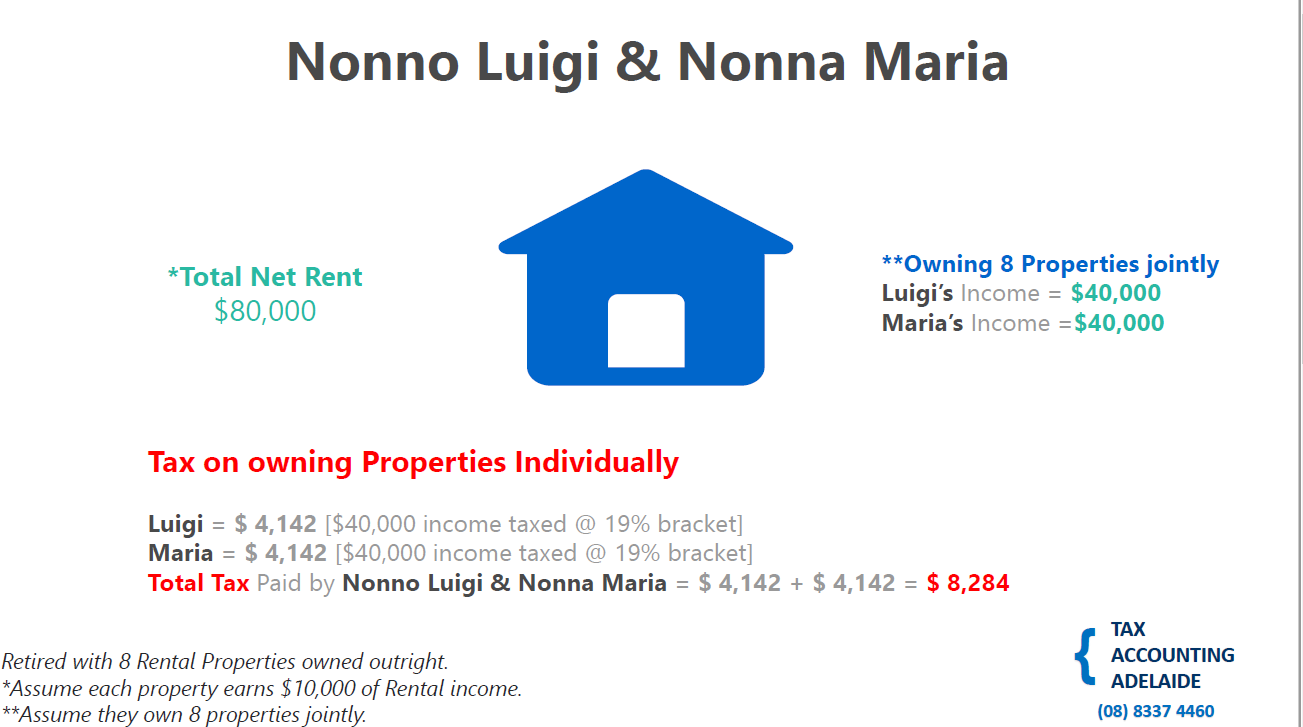

Let say

Luigi and Maria

Retire with 8 rental properties owned outright

Sounds great

But if they owns them individually

They could still have a high taxable income

Lets assume 40k taxable income each

So that would be income taxes of about 4k each

In case one if one dies, it would become more tax too

The income would go all to one so taxable income of 80k becomes 17k tax

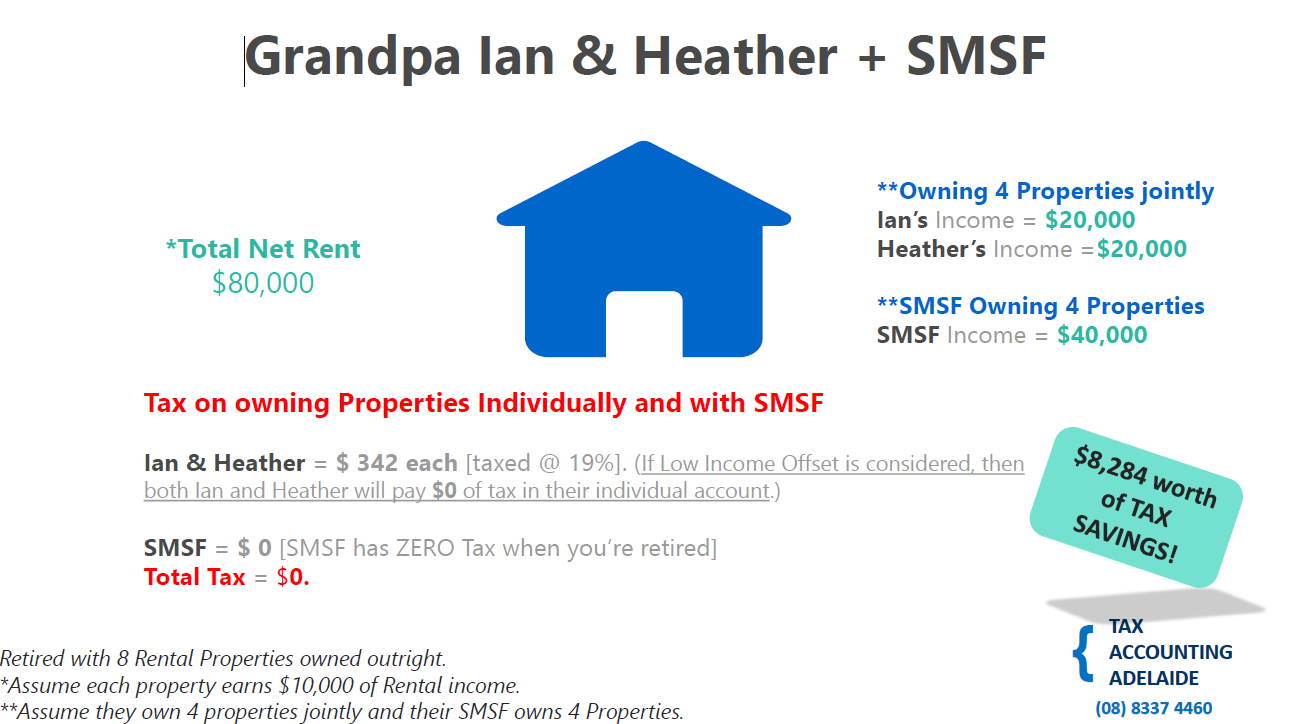

Compared to

Ian and Heather

They also retire with 8 rental properties owned outright

But they own 4 jointly individually and own 4 in there self managed super fund

Their individual tax return on 20k each would be no tax

If one dies

The income would go all to one so taxable income of 40k becomes 4k tax

And rental profit in the self managed super fund are tax free after retirement

So in this case the Ian and Heather have a better tax structure saving 8k tax even though they have the same rental properties of Luigi and Maria

Learn More about smsf Property Investment Advice SMSF Call Back