Tax Returns Explained Simply

Watch this video to find out how it all works in your tax return refund or payable.

See tax rates below

A simple tax return is really not that simple.

But let me dumb it down so if you have never really understood it, you soon will.

You start with Incomes (like wages and salaries) less deductions (like uniforms and cost of tax preparation fee) which give you what the tax office calls TAXABLE INCOME

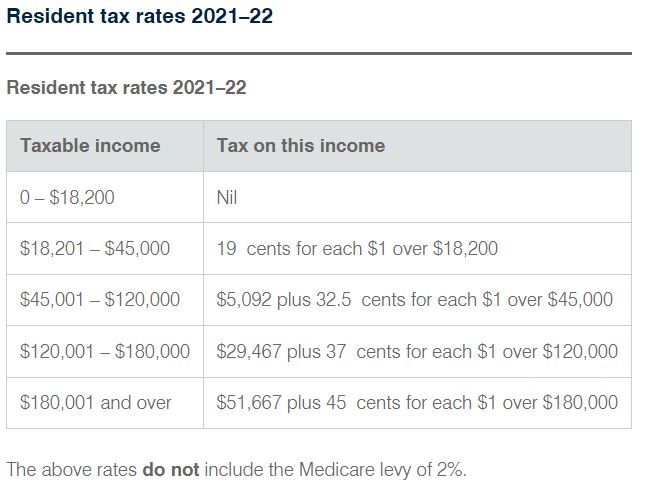

Once you have your taxable income , depending on how high it is, you are taxed progressively more as in this table of the Income tax rates. This is called Tax on your Taxable Income.

2023–24

|

Taxable income |

Tax on this income |

|---|---|

|

0 – $18,200 |

Nil |

|

$18,201 – $45,000 |

19c for each $1 over $18,200 |

|

$45,001 – $120,000 |

$5,092 plus 32.5c for each $1 over $45,000 |

|

$120,001 – $180,000 |

$29,467 plus 37c for each $1 over $120,000 |

|

$180,001 and over |

$51,667 plus 45c for each $1 over $180,000 |

The above rates do not include the Medicare levy of 2%.

2022–23

|

Taxable income |

Tax on this income |

|---|---|

|

0 – $18,200 |

Nil |

|

$18,201 – $45,000 |

19c for each $1 over $18,200 |

|

$45,001 – $120,000 |

$5,092 plus 32.5c for each $1 over $45,000 |

|

$120,001 – $180,000 |

$29,467 plus 37c for each $1 over $120,000 |

|

$180,001 and over |

$51,667 plus 45c for each $1 over $180,000 |

The above rates do not include the Medicare levy of 2%.

Resident tax rates 2019–20

|

Taxable income |

Tax on this income |

|---|---|

|

0 – $18,200 |

Nil |

|

$18,201 – $37,000 |

19c for each $1 over $18,200 |

|

$37,001 – $90,000 |

$3,572 plus 32.5c for each $1 over $37,000 |

|

$90,001 – $180,000 |

$20,797 plus 37c for each $1 over $90,000 |

|

$180,001 and over |

$54,097 plus 45c for each $1 over $180,000 |

The above rates do not include the Medicare levy of 2%.

Resident tax rates 2018–19

|

Taxable income |

Tax on this income |

|---|---|

|

0 – $18,200 |

Nil |

|

$18,201 – $37,000 |

19c for each $1 over $18,200 |

|

$37,001 – $90,000 |

$3,572 plus 32.5c for each $1 over $37,000 |

|

$90,001 – $180,000 |

$20,797 plus 37c for each $1 over $90,000 |

|

$180,001 and over |

$54,097 plus 45c for each $1 over $180,000 |

The above rates do not include the Medicare levy of 2%.

The above rates include changes announced in the 2018-19 Federal Budget.

Once you have tax on taxable income you add medicare levy. Then you take off any taxes paid (such as on wages) and any tax offsets (such as education tax refund)to get your tax return refund or amount payable. If you have already paid more tax than the tax on taxable income then you get a refund.

For more examples and explanations of Income, deductions, taxes paid and tax offsets visit www.ATO.gov.au or ask us

Here is your bonus PDF version

Tax return explained simply by an online tax agent

Here is your bonus Audio Version

explanation of tax returns by tax agent Tax Accounting Adelaide