Share investing ideas

Share investing

Are you thinking of starting a share portfolio?

Or if you aren’t yet, then perhaps you should be.

I must say being an accountant, I began to take notice when seeing my clients show me their substantial share portfolios, often commencing them as late as their fifties.

Reasons why you would invest in shares are :

- They are fairly liquid, easy to sell or dispose. More so than property can be.

- Long term historical share returns are good.

- Taxation on share income of dividends can be tax smart as your get company paid tax credits, called a franking credit.

- Investing directly into shares in your self managed super fund can be an even greater idea. You can get tax deductions for contributing to your super and the super tax rate is lower than outside super.

Here are some non specific advice general tips for you.

- as with any investing, regular investing allows your compound interest to give you long term growth.

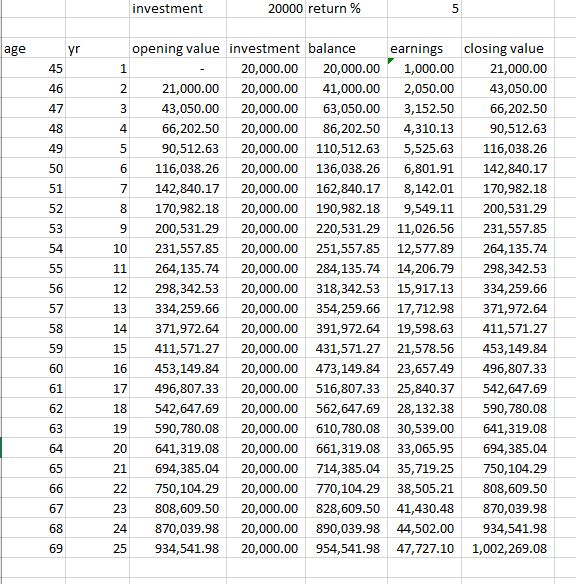

- so commit to an regular annual annual to invest. I used the example I show you below that a 45 year old can grow an investment of $1,000,000 by the age of 69 by investing $20000 per year with a return of 5%. I like to say look at your income surplus over expenses, then pay for your shares of say $20000 per year first then pay all else after that. Basically, invest before all else.

- Share investing is not gambling. Gambling is betting a minor probability will occur. Whereas companies can be very professional entities, with smart ideas and smart people driving up their value.

- Share investors often make the mistake of hanging on too long to poor stocks and selling their greatest stocks too early. So the point is sell a plummeting stock as early as possible and hang on to the rising stocks you have.

- Consider dividend reinvestment, which buys more shares with your share dividends. Be sure to keep all your dividend notices as you may need them for tax purposes and until you sell the shares.

- You can also buy international shares too such as Apple, Microsoft, Pfizer and Google.

- If you do not know enough about share investing, perhaps start with a course, get a share mentor or share advisor. Our firm can introduce you to one.

Case Study

Our case study showing a 45 year old can grow an investment of $1,000,000 by the age of 69 by investing $20000 per year with a return of 5%.

This is an estimate only, actual closing values may vary depending on actual stocks purchased and their returns.

Building wealth is hard work, but by committing to a regular investment and with some knowledge or guidance, you too can build a share portfolio.