Articles, Updates and Information to help you

- All

- Business

- Industry

- Personal and Individual Tax

- Self Managed Super Fund

- Tax Accounting Adelaide

Hot property suburbs in Adelaide

Here are some hot property suburbs to invest in Adelaide. Prospect Newton South Brighton Henley beach Fulham Kurralta park Park Holme Seaford Meadows West Lakes Lightsview Unley Parkside Please seek…

Thinking of working overseas

If you are an Australian considering working overseas, we recommend seeking tax advice to plan fully for your Australian Tax Law implications. Importantly … Australian residents are generally taxed on…

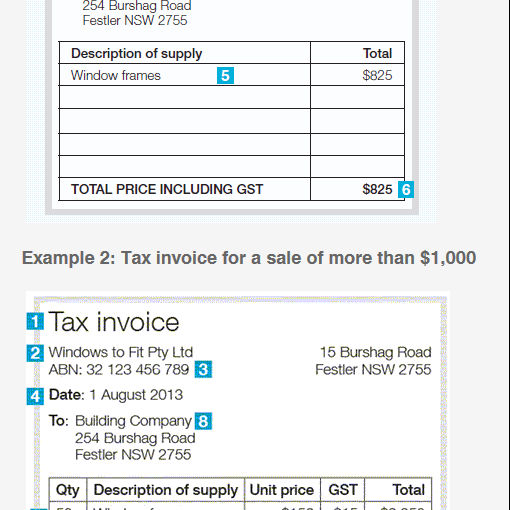

Registering for GST

If you are thinking of starting a business, then you need to understand whether or not you need to be registered for GST. This is not to be confused with…

We Have All Your Business Tax Accounting Covered!

Running a business can be time consuming and if you are like most business owners, you want to spend your time improving sales and looking at the big picture. Your…

Here’s What To Do With A Late Tax Return

Are you late in lodging your tax return? Here’s some information you should know and the steps to take if you are in this situation. The Australian Taxation Office (ATO) may…

New rules for property investors 2018

With the uncertainty spotlight on the Australian federal government budget o reduce the ability of rental property owners to claim tax deductions for rental ownership expenses, we outline some of…

7 Ways to refer to us

7 ways to refer to us We are looking for genuine referral partners Can you help? Well I am giving you a video explaining 7 ways to refer to me….

Ways You Didn’t Know Your Tax Accountant Could Help You

You may think your accountant’s only purpose is doing your tax return at the end of the financial year however this is only a fraction of the service they can…

The Benefits Of Seeing A Professional Tax Agent

There are many ways that a tax agent can provide a positive financial benefit to you. A good tax agent will have useful tips and strategies that can improve your…

Get More From Your Tax Return This Financial Year With A Professional Tax Agent!

Professional tax agents are in the business of managing tax affairs for individuals and businesses. They love to save you money and reduce tax. They can assist from many financial…